how to get amazon flex tax form

The FTC brought a. In the Year-end tax forms section click Find Forms Click Download.

If you are a US.

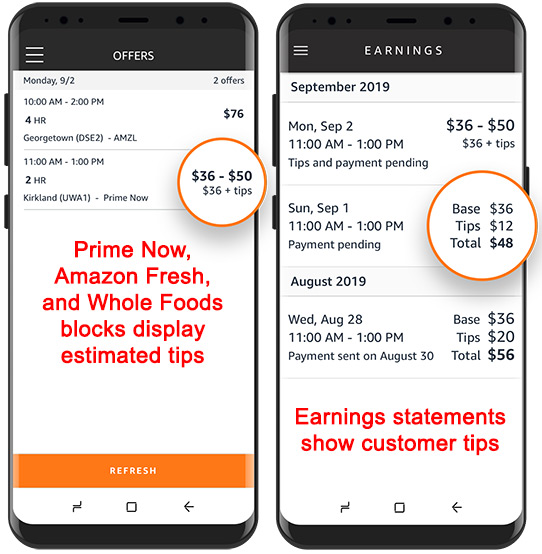

. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone. Since we are now considered self employed contractors we are now responsible for own taxes including payroll deductions for Social Security and Medicare. Taxes for Uber Lyft Postmates Instacart Doordash and Amazon Flex drivers are handled differently than what most full time workers are used to.

Mail a 4506-T Request for Transcript of Tax Return form which can be found on the Printable Forms section of our webpage wwwhostoscunyeduofa. Get it as soon as Tomorrow Feb 16. If youre looking for a place to discuss DSP topics head over to ramazondspdrivers.

Unless you have some unique circumstances you should have nothing to report on lines 2 4 and 6 and therefore your GROSS INCOME on Line 7 should equal the amount you wrote in on Line 1. This is your business income on which you owe taxes. Select a location on your computer and click Save.

Click the Download PDF link. In reality you could have filled this out without the 1099 form. We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity.

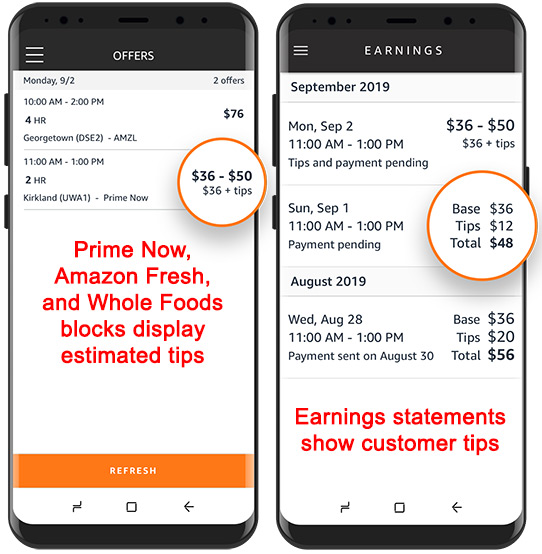

Generally payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive. Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. The FTC is sending payments totaling nearly 60 million to more than 140000 Amazon Flex drivers who had their tips withheld from them by Amazon between 2016 and 2019.

Most drivers earn 18-25 an hour. Understand that this has nothing to do with whether you take the standard deduction. This form will have you adjust your 1099 income for the number of miles driven.

Box 80683 Seattle WA 98108-0683 USA. Amazon Payments will mail a copy of your form to the address which you provided when you gave us your Tax ID Number EIN or Social Security Number. This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but still have to report the income otherwise youll receive filing penalties.

Supplier number vendor code publisher code etc. Gig Economy Masters Course. 12 tax write offs for Amazon Flex drivers.

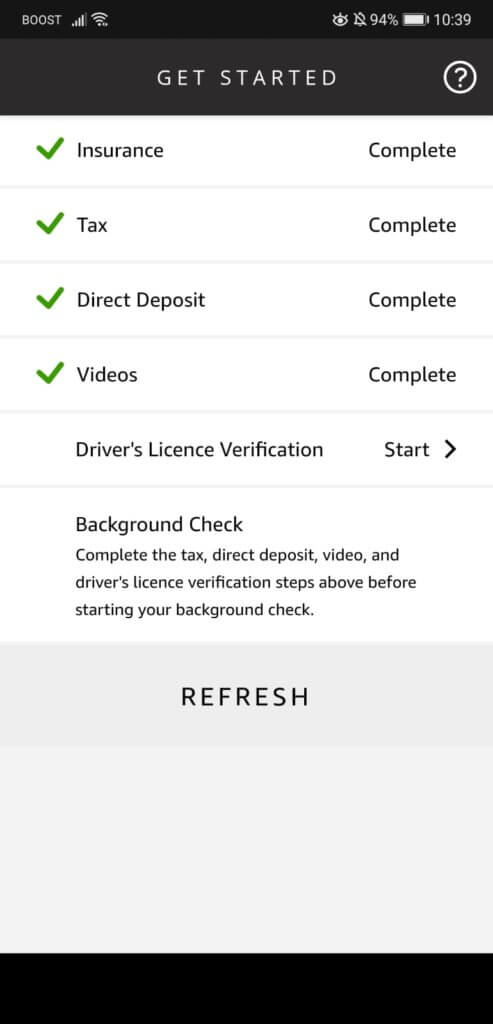

Youll need to submit a tax return online declaring your income and expenses once a year by 31 January as well as paying tax twice a year by 31 January and 31 July. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. Amazon will either mail or email you your form 1099-K depending on whether or not you consented to having tax forms sent to you electronically.

Driving for Amazon flex can be a good way to earn supplemental income. To download your form electronically follow these steps. Its almost time to file your taxes.

Payee and earn income reportable on Form 1099-MISC eg. This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. Royalty or rent income by participating in one or more Amazon programs you may be eligible to receive a 1099-MISC if you meet the reporting threshold 10 for royalties and 600 for all other payments.

Youll need to declare your amazon flex taxes under the rules of HMRC self-assessment. To save the form to your computer while it is open in Adobe Reader click File then Save As and then PDF. Please include the following information on your form so that we can locate your account.

46 out of 5 stars. Tax Returns for Amazon Flex. 2 Go to the Reports Section.

Will I also get a 1099-MISC form. If you think you should have received a form 1099-K but didnt you can check on it in your Seller Central Account. Adams 1099 MISC Forms 2021 Tax Kit for 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online TXA12521-MISC 46 out of 5 stars.

Blue Summit Supplies 1099 NEC Tax Forms 2021 with 25 Self Seal Envelopes 25 4 Part Tax Forms Kit Compatible with QuickBooks and Accounting Software. If you have not received your Form W-2 by the due date and have completed steps 1 and 2 you may use Form 4852 Substitute for Form W-2 Wage and Tax Statement. Knowing your tax write offs can be a good way to keep that income in your pocket.

Attach Form 4852 to the return estimating income and withholding taxes as accurately as possible. Amazon business for which you are supplying information. Increase Your Earnings.

There may be a delay in any refund due while the information is verified. Once you have completed the form and signed with blue or black pen please mail to Amazon at. Amazon Flex drivers deliver goods and groceries ordered through programs like Prime Now and AmazonFresh which allow customers to leave tips for their drivers.

In your example you made 10000 on your 1099 and drove 10000 miles. From the Reports section in your seller account select Tax Document Library then the appropriate year and then Form 1099-K. Write in the amount that is shown on form 1099 BOX 7.

Created Jul 5 2016. 1 Login to Seller Central.

How To File Amazon Flex 1099 Taxes The Easy Way

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels